Tax Credit Tankless Water Heater 2017

Uniform energy factor uef 0 82.

Tax credit tankless water heater 2017. Qualified equipment includes solar hot water heaters solar electric equipment wind turbines and fuel cell property. 300 for any item of energy efficient building property. Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs. Residential gas oil propane water heater.

Residential electric heat pump water heater. This includes the cost of installation. 12 31 2017 through 12 31 2020. Federal income tax credits and other incentives for energy efficiency.

The renewable energy tax credits are good through 2019 and then are reduced each year through the end of 2021. 150 for any qualified natural gas propane or oil furnace or hot water boiler. A nonrefundable tax credit allows taxpayers to lower their tax liability to zero but not below zero. This tax credit is 30 percent of the cost of alternative energy equipment installed on or in a home.

The tax credit is for 50. The tax credit is for 50. Geothermal wind and fuel cell renewable energy tax credits had previously been extended through 2021 to. The tax credit is for 300.

Through the 2019 tax year the federal government offers the nonbusiness energy property credit. Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020. Tax credits for all residential renewable energy products have been extended through december 31 2021 and feature a gradual step down in the credit value. Residential electric heat pump water heater.

The tax credit is for 300. The residential energy property credit is nonrefundable. Federal income tax credits and other incentives for energy efficiency. The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

Claim the credits by filing form 5695 with your tax return. Uniform energy factor uef 0 82. A tankless water heater tax credit is a government s tax credit to citizens who take advantage of switching to a more energy efficient tankless hot water heater. 1865 that was signed in december of 2019 residential energy property tax credits aka the non business energy property tax credits have been retroactively extended from 12 31 2017 through 12 31 2020.

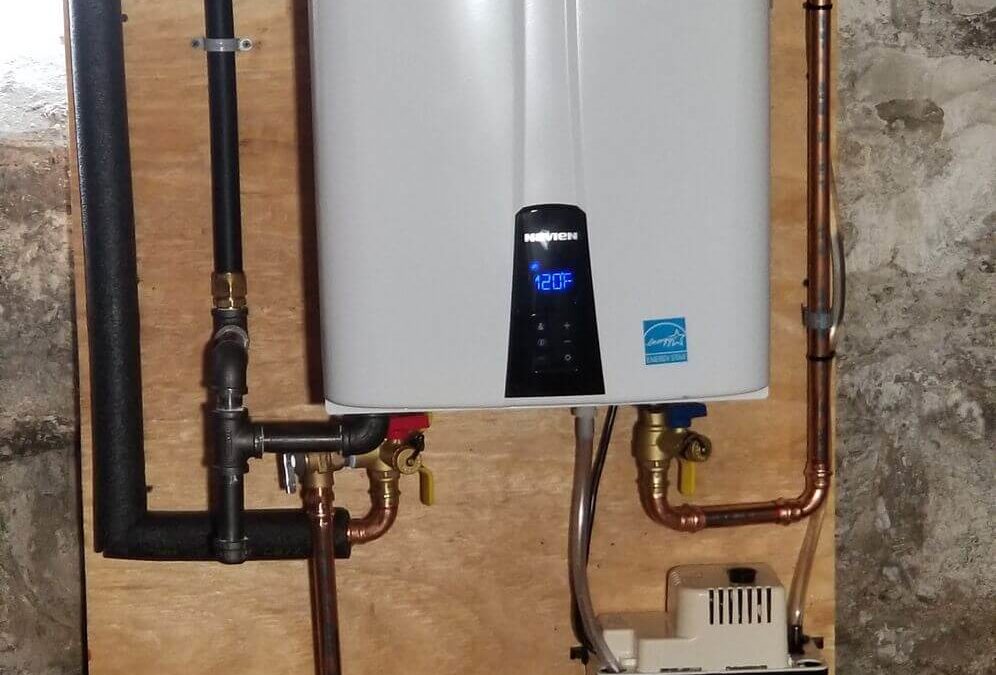

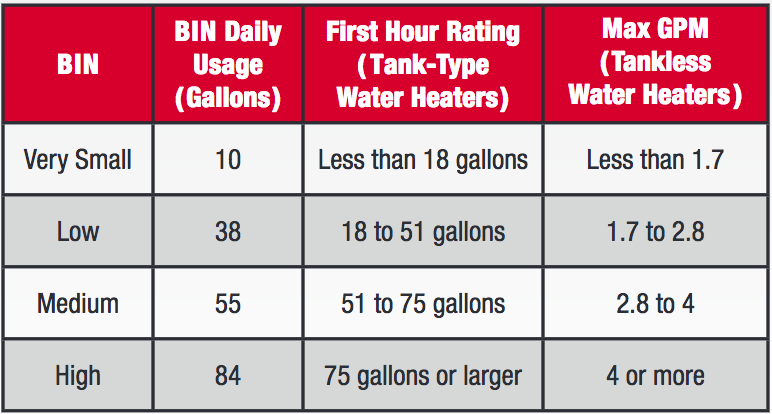

Residential water heaters or commercial water heaters and select yes for tax credit eligible under advanced search. There are also other individual credit limitations. Residential gas oil propane water heater. Home tankless gas water heaters.

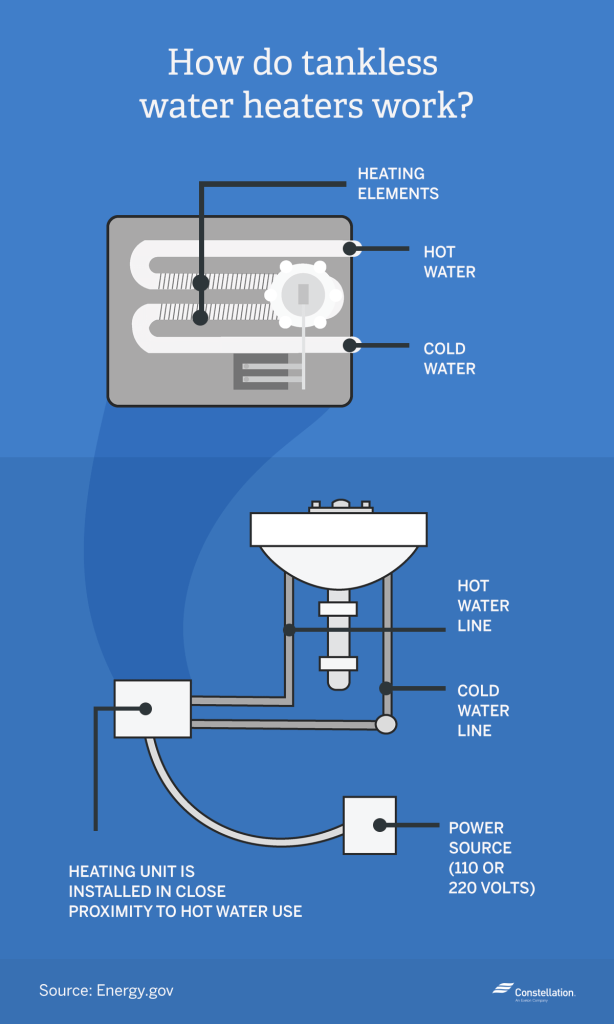

Residential water heaters or commercial water heaters and select yes for tax credit eligible under advanced search. These types of hot water heaters have been around for a while and many models offer a less energy consuming option for keeping a home supplied with hot water. Tankless water heater tax credits are often part of an initiative to improve a nation s overall carbon footprint or lower average energy use through the tax code.